by Steve McDonald, Investment U Research

Monday, February 20, 2012

Corporate and municipal bond investing has one major problem: When interest rates go up, bonds go down.

Actually, bond investing has two major problems. The second is that people are rate pigs. They always go for the highest payout on bonds and bond funds and ignore the problems associated with long maturities.

The result is that when bonds do drop in value, which they will do at some point, the drop is accelerated by ?rate pigitis? ? really accelerated. Long maturities drop in value a lot more than short ones.

So, a bond investor has to make a choice:

- Go with really long maturities, get higher yields and suffer through the sell-off when rates go back up?

Or:

- Go for shorter maturities and put up with lower returns, but a much smaller drop in value when the sell-off finally happens?

Of course, there are those who think, ?I?ll just wait it out and collect my interest, ignore the big drop in long maturity bonds and collect my principal at maturity.?

Right! And Obama will suddenly develop a sense of business and economics and stop jerking everyone?s chain.

The Real Truth

Here?s the real truth about the average small-bond investor.

The combination of ?rate pigitis? and being completely unable to wait out a sell-off in any market ? not the just the bond market ? have turned one of the safest investments, bonds, into what will be one of the biggest money losers in the history of the markets. Treasuries included.

In the past few years, rates have settled where I have never seen them in my lifetime. Meanwhile, small investors have been standing in line to pour their money into bonds of all kinds in the hope of escaping the stock market volatility and getting some kind of return on their money. I can understand why? It?s been 10 years since we made a dime on stocks.

All of this money is going into bonds at exactly the wrong time, in all the wrong ways and at prices so high, they have to come down.

It will be a blood bath of biblical proportions when almost everyone cuts and runs as prices drop.

The Staggered Approach to Bond Investing

But this is completely avoidable. There?s a way to own bonds now and get around this impending bloodbath, and still beat the stock market.

In fact, if you use a staggered approach to bonds, rather than the usual ladder, you can:

- Get very high rates of returns.

- Minimize the drop in value when interest rates rise.

- Take advantage of higher rates and the bargains they present in a down bond market.

- And still sleep at night, too?

I know, too good to be true, right?

But this isn?t a guarantee of any kind, you will have some losses ? very few, but some. Based on today?s market averages about one to three out of a 100 trades will be losers.

Sounds good, doesn?t it?

And, you will have to follow all the rules! Yes, rules of the road that cannot be ignored. Any Navy folks out there know what that implies. Standing Orders and all!

Right off the bat, that eliminates about 25% of all investors, big and small. That bottom 25% is doomed by the fact that they don?t know what to believe and are so inexperienced they can?t separate the good information from the garbage.

Another 25% will only play the ?swing for the fence? game in the stock market. They will figure it out eventually, but not until they have lost so much they go back to CDs and money markets. At least they aren?t losing anymore.

Another 25% know they have the secret to success and will only buy stocks, because they know the secret, right?

So that leaves you and me and few other survivors who are able to see a real opportunity.

Here it is! It?s called a ?staggered bond portfolio.? Your broker will tell you it can?t work, but I have been proving him wrong for a long time.

Forget Everything You Know

First, forget everything you know about corporate bonds, and munis for that matter, especially how to structure a portfolio of them.

Think in terms of very small bond positions, as few as one bond per position, five or more is preferable, but you can do one. I know brokers will tell you it is impossible to buy less than 10 or 20 bonds. Baloney! Get another broker who knows something about bonds!

The Rules of the Road

- Buy many bonds of almost all credit qualities, as low as CCC. Right now, I prefer to stay in the BBB to CCC range, but the skittish can go for the higher ratings if you need them to sleep at night. But the BBB to B ratings don?t have that much more risk and the slightly lower-rated bonds are where all the money is.

- Buy bonds in many industries. Don?t load up on a few tech names or familiar names. Stay diversified just as in a stock portfolio.

- In the current market, shoot for an average maturity of five years or less. That means you can buy a few really good ones at seven years and a few that don?t look as good in the one- to two-year maturity. Then fill in the blanks.

As the market shifts to higher interest rates, this strategy will shift to longer maturities and the higher rates that come with them. But for now, you must stay very short on time. This market requires it.

- Never load up on a single bond because you like the return. This is the biggest trap and the biggest money burner in the business. Just ask the folks who bought Lehman Bros. bonds, AAA at the time, because they had a great interest rate and a really good rating.

For the average person, that?s someone who isn?t managing millions, there?s never a good enough reason to buy more than 10 bonds in any one position.

Plan on buying lots of different bonds so when the bad news does hit (and it will eventually), it only affects about one to four bonds out of a 100, and you don?t have your whole life hung out to dry in one position. I?ll bet you can guess which bonds will get you into trouble. Here?s a hint, it won?t be the small positions in your portfolio.

- Look for bonds whose underlying companies just had some bad news; missed earnings, bad product, lawsuit, etc. It will kill the stock and the bond will slip, too, but here?s where the difference between stocks and corporate bonds really shines.

The only question you need to ask yourself about that bond is, ?Will the company be in business when this bond matures?? The answer in almost 99% of cases is, ?Yes.?

That?s it! Let the stockholders die on the vine as this thing gets pummeled. You buy the bond while it?s down, collect the interest and capital gains, wait for the bond to go back up in value ? which they do in most cases ? then sell it or wait for maturity and collect your principal and interest.

Two More Advantages

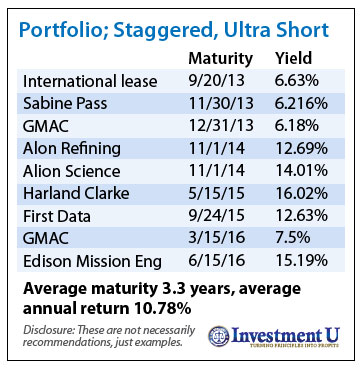

There are two more advantages to this short staggered portfolio. Take a look at the example below of what a portion of a complete staggered portfolio looks like.

Notice you have several bonds coming due each year. This is key to this strategy. This allows you to buy back into the market at higher rates several times a year. This gives you all kinds of flexibility that laddering doesn?t.

In a traditional laddered portfolio, you have to wait several years for a bond to mature to be able to buy another. That can hurt in a fast changing bond market, which is what I?m expecting in the next few years.

Maybe the most beneficial aspect of the staggered strategy is you can see the horizon. You can see that there?s money coming due, and you know you will get your principal back, and that gives you a psychological advantage over all other types of investments.

Being able to see that horizon ? I call it the light at the end of the tunnel ? makes it that much easier to sit tight and wait out the worst that any market has to offer.

You have to be there at the end of the race to have any chance of being a winner.

That?s how you avoid the bloodbath that?s coming in the bond market, reduce your risk, avoid the volatility of the stock and make real money in bonds.

Good Investing,

Steve McDonald

Any investment contains risk. Please see our disclaimerRelated Investment U Articles:

Comments

**By submitting your comment you agree to adhere to our Comment Policy and Privacy Policy.Source: http://www.investmentu.com/2012/February/guide-to-bond-investing.html

war in iraq war in iraq barbara walters government shutdown jacksonville jaguars jacksonville jaguars iraq war over

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.